Last updated: November 4, 2025

Why the Global Oil and Gas Market Matters

The “oil and gas market” is more than just price tags at the pump or the flick of a switch when you turn on your heater. It is a sprawling, global, high-stakes ecosystem that underpins virtually every modern economy. From transportation to manufacturing, from geopolitics to climate policy, from energy security to everyday living — few industries have such wide-reaching impact.

This article aims to serve as a comprehensive, accessible guide to the fundamentals of the oil and gas market: how it works, why it moves, who the players are, what influences it, and what the major trends are. Although the subject is complex and often filled with specialized jargon, you can refer to our detailed Ultimate Guide to Oil and Gas Terminology. The goal here is to provide clarity to not only professionals but also curious readers, students, policy-makers and anyone interested in how this world really works.

Let’s begin the journey.

1. Global Overview of the Oil and Gas Market

What do we mean by “oil & gas market”?

When we talk about the “oil and gas market”, we are referring broadly to the systems of exploration, production, transportation, refining/processing, distribution and consumption of hydrocarbons — primarily crude oil and natural gas — as well as the trading, pricing and investment markets built around them.

In practical terms, it covers:

- The upstream side: finding and extracting oil/gas.

- The midstream side: transporting, storing and processing.

- The downstream side: refining, distributing and selling end-products (fuel, petrochemicals, etc.). (Investopedia)

- The global trading and financial aspect: benchmarks, futures, inventories, price signals, global supply-demand balances. (U.S. Energy Information Administration)

Why is it global?

The oil and gas market is inherently global for several reasons:

- Oil and gas reserves exist in many different countries, but consumption happens everywhere. As a result, production in one region may impact consumers (or producers) somewhere else. (The Strauss Center)

- The pricing and trading of crude oil and natural gas occur in global markets with benchmarks that cross borders. (Research Guides)

- Infrastructure (tankers, pipelines, shipping, storage) spans continents.

- Policy decisions, geopolitics and environmental concerns (such as climate change) mean that regional actions often have global effects.

In short: what happens in the Saudi desert or offshore Brazil can ripple into fuel prices in Europe, manufacturing costs in Asia, and energy security in Africa.

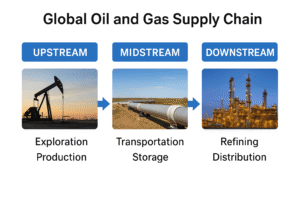

2. Understanding Upstream, Midstream, and Downstream Operations

To understand the market, it helps to break it into its major operating segments: upstream, midstream and downstream. (oilandgasiq.com)

Upstream

This is exploration & production (E&P). Companies locate potential oil and gas reserves, drill wells, extract hydrocarbons from underground or undersea reservoirs.

Key characteristics:

- High risk: drilling may fail, reservoirs may underperform.

- High capital investment: rigs, technology, seismic surveys, specialist personnel.

- Long lead-times: many years can elapse between discovery, development and production.

- Reserve management: proven, probable, possible reserves are key metrics. (Investopedia)

Upstream directly influences supply.

Midstream

Once the hydrocarbons are out of the ground, they must be transported, stored, processed (especially natural gas), and delivered to refineries or to distribution networks.

Key components: pipelines, tanker ships, storage terminals, LNG (liquefied natural gas) infrastructure, processing plants. (Wikipedia)

Midstream is often more regulated (pipeline corridors, shipping routes, cross-border infrastructure) and its economics are different: often lower or more stable margins but critical for movement of product.

Downstream

This is refining, converting crude oil and natural gas into usable products (gasoline/petrol, diesel, jet fuel, heating oil, petrochemicals, plastics, etc.) and the marketing/retailing side (fuel stations, wholesale distributors). (Investopedia)

Downstream margins depend on refinery configuration, feedstock quality, product demand, regulatory issues (emissions, fuel standards) and competition.

Why the segmentation matters

Understanding these segments helps you see where value is created (and at what cost), where different risks lie (geological risk upstream, regulatory risk midstream, product demand risk downstream), and how changes in one segment (say a transport disruption) ripple into others.

3. Global Supply, Demand, and Trade Dynamics

The simple economic model of supply, demand and price holds – but in the oil and gas market it plays out with special features.

Supply

Production of oil and gas depends on geology (do reservoirs exist?), cost structure (how expensive to extract?), technology (offshore vs onshore, fracking, deep water), and policy/regulation.

A useful teaching guide lists supply as one of the pillars of the oil market basics. (U.S. Energy Information Administration)

Supply is also influenced by:

- Political/regulatory decisions (licensing, taxes, production sharing contracts).

- Ongoing investment: fields naturally decline over time and to keep production flat one must invest in new capacity.

- Technological changes that reduce cost or open new plays (shale, deep water).

Demand

Demand for oil and gas comes from many sectors: transportation, power generation, manufacturing, petrochemicals, heating/cooling, mobile economy.

Demand growth is strongly correlated with economic growth, industrialisation, population growth. For example, emerging markets often drive incremental demand growth. (oilandgasiq.com)

Demand is impacted by:

- Energy efficiency improvements (e.g., fuel-economy standards).

- Alternative energy penetration (electric vehicles, renewables).

- Changing consumer behaviour, policy/regulation (carbon pricing, emissions limits).

Trade

Because oil and gas are unevenly distributed globally, trade becomes central. Countries that produce more than they consume export; those that consume more than they produce import.

Trade links supply and demand across borders. The global oil market has become more integrated. (The Strauss Center)

It also means that stocks/inventories, shipping costs and logistics often matter for price behaviour.

Price formation

The price of crude oil and gas is determined through numerous transactions, physical and financial, and is influenced by supply, demand, trade, inventory and market expectations. The U.S. Energy Information Administration describes oil markets as “essentially a global auction—the highest bidder will win the available supply.” (U.S. Energy Information Administration)

Key benchmarking crude grades (e.g., Brent Blend, West Texas Intermediate (WTI), Dubai Crude) help reflect quality, location and logistics differentials. (Research Guides)

Refined-product margins (such as “crack spread”) reflect downstream economics. (Wikipedia)

4. Important Oil and Gas Market Benchmarks and Metrics

To engage meaningfully with the oil and gas market, we must understand some of the important benchmarks and metrics.

- Barrel (bbl): Standard unit of measure for crude oil, equals 42 US gallons (≈159 litres). (Investopedia)

- BOE (barrel of oil equivalent): A way to convert natural gas volume into an equivalent energy content of oil (commonly used in E&P reporting). (Investopedia)

- Crude oil benchmarks:

- Brent Blend (North Sea): widely used globally. (aegis-hedging.com)

- WTI (USA).

- Dubai/Oman (Persian Gulf for Asian markets).

- Crack spread: The difference between crude oil price and the petroleum products derived from it (an indicator of refining profitability). (Wikipedia)

- Upstream/Downstream etc.: As discussed in section 2.

- Inventory/stock: The level of stored crude oil or refined products – high inventories may suppress prices, low inventories may push them up.

- Contango/Backwardation: Financial term for futures price structure – when future prices are higher than spot (contango) or lower (backwardation); this can reflect expectations of supply/demand. (Wikipedia)

- Production sharing agreements (PSAs): Contractual structures between governments and oil companies defining how production and profits are shared. (Wikipedia)

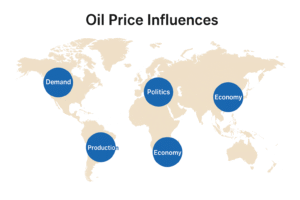

5. Factors Influencing the Global Oil and Gas Market

Here we examine the key drivers and dynamics that shape the oil & gas market globally.

5.1 Geopolitics

Oil and gas are strategic commodities. Major producing nations, export corridors, and global alliances (such as Organization of the Petroleum Exporting Countries (OPEC) + non-OPEC) all play important roles. For example:

- Production cuts or increases by OPEC members can move global supply.

- Political instability (in exporting countries) can create supply shocks.

- Sanctions (on producers or buyers) can limit flows and distort price signals.

Hence the market often responds strongly to geopolitical events.

5.2 Technological Change & Cost

Advances in extraction (e.g., shale fracking, ultra-deepwater drilling) have changed the supply landscape, especially in the United States. This has implications for access, cost curves, and competitive supply.

Lower extraction/production cost means more producers can operate profitably at lower prices, which shifts global supply dynamics.

5.3 Supply & Demand Shocks

Events such as natural disasters, major pipeline disruptions, refinery outages, pandemics (e.g., COVID-19) can sharply affect supply or demand.

On the demand side: economic slowdowns or accelerations, shifts in mobility habits, policy changes influence consumption.

Inventory changes (i.e., stocks) are also important: rising inventories often signal oversupply, pushing prices down; conversely, falling inventories may suggest tighter markets and higher prices.

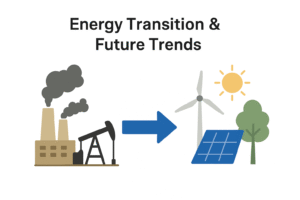

5.4 Energy Transition & Policy/Environmental Factors

In recent years the role of environmental policy and the shift toward low-carbon energy have become major influences.

- Regulations on emissions, fuel standards, carbon taxes can affect demand for oil/gas or change cost structures.

- The growth of renewables, electric vehicles (EVs), energy efficiency measures reduces long-term demand growth for oil.

- On the supply side, some countries/companies are increasingly constrained by climate policy and investor pressure.

5.5 Infrastructure & Midstream/Downstream Constraints

Even if upstream production is available, bottlenecks in pipelines, shipping, storage, refining capacity can create local supply constraints that ripple into price.

For example, if a major refinery goes offline, then product shortages can occur; if shipping/transport is disrupted, supply to certain regions may be constrained.

5.6 Financial Markets & Speculation

Oil and gas are traded not only physically, but also via futures, options, derivatives. Market participants include producers, consumers, traders, speculators.

Expectations of future supply/demand, storage costs, geopolitical risk feed into futures prices and thus spot pricing decisions. (b2broker.com)

Also, investment decisions in the upstream segment (which take years to bear fruit) are shaped by price expectations.

5.7 Regional Divergences

While we talk often of a “global market,” regional differences persist:

- Transportation costs and logistics matter a lot (e.g., oil shipped to Asia vs Europe).

- Infrastructure availability differs (for instance pipelines in U.S. vs LNG shipping).

- Demand profiles differ: developed economies vs emerging markets; seasonal demand cycles (heating oil in winter, cooling in summer).

Because of these, local price spreads and arbitrage opportunities exist.

6. Oil and Gas Market Value Chain Explained

A useful way to view the oil & gas market is to walk through the value chain—how raw hydrocarbons go from underground to end-use.

Step 1: Exploration & Production (Upstream)

- Geologists and engineers identify potential reservoirs via seismic surveys, geology.

- Companies drill exploration wells; if commercial quantities of oil/gas are found, then development wells may follow.

- Production begins: large-scale extraction, well servicing, reservoir management.

- Example metrics: barrels per day (bbl/d), reserves (proven/probable). (Investopedia)

- Cost elements: drilling, completion, fracturing (in the case of unconventional), pumping, maintenance.

- Risks: drilling can fail; reservoir performance may drop more quickly than expected; regulatory/contractual risk.

Step 2: Transportation, Storage, Processing (Midstream)

- The crude or gas must be moved from field to refinery or processing plant: pipelines, ships (tankers), rail, trucks.

- For natural gas, processing often includes removing impurities, conditioning, liquefaction (for LNG) or compression.

- Storage plays a role: oil or gas may be stored when supply is abundant or demand is weak; storage availability can influence pricing (see contango/backwardation). (Wikipedia)

- Import/export flows depend on infrastructure, shipping, tariffs, logistics.

Step 3: Refining and Conversion (Downstream)

- Refineries convert crude oil into usable products: gasoline/petrol, diesel, jet fuel, heating oil, petrochemicals, asphalt, lubricants etc.

- The efficiency of a refinery depends on its configuration (whether it can handle heavy/light crude, sulphur content, etc.).

- Refining margins depend on input crude cost, product demand, regulatory constraints (fuel standards, emissions).

- For gas, the downstream includes distribution networks to end-users, as well as conversion into LNG or other forms for transport.

Step 4: Distribution & Retailing

- Fuel stations, wholesale distribution, pipelines to local storage, shipping to end users.

- Petrochemicals: some oil/gas output is diverted into plastics, fertilisers, industrial chemicals.

- Final consumption: transportation (cars, trucks, shipping, aviation), industry (manufacturing, petrochemicals), residential/commercial (heating/cooling), power generation.

Step 5: End-Use and Beyond

- Consumers purchase fuel, heating oil, jet fuel, natural gas.

- Pricing at this level includes taxes, transportation, retail margin, refining cost, crude cost.

- Behaviour and demand response: higher prices often lead to demand reduction or substitution (e.g., switching to electric vehicles, more efficient appliances).

7. Major Trends and Challenges in the Oil and Gas Market

7.1 Peak Demand & the Energy Transition

Many energy analysts, companies and governments now suggest that “peak oil demand” may be approaching or may have already occurred. For instance, British Petroleum (BP) predicted global oil demand could peak by 2025. (The Guardian)

That doesn’t mean oil will disappear overnight, but the growth phase may be slowing, which has implications for investment, production planning and country economies that depend heavily on hydrocarbons.

7.2 Investment and Declining Fields

According to the International Energy Agency (IEA), the oil & gas industry needs to spend large sums just to maintain current production levels because many producing fields are in decline. (Financial Times)

This challenges the notion that low investment today means low supply soon — the opposite may occur: supply shortages if investment stops.

7.3 Geopolitical Realignment and Regional Shifts

As new producers emerge (shale oil in the U.S., offshore Brazil, unconventional in Africa, new Middle East developments), the global supply map is changing. This shifts power dynamics, trade flows and vulnerabilities.

For example, some of the traditional dominance of a few major exporters is being eroded, increasing market complexity. (The Strauss Center)

7.4 Technological Disruption

From hydraulic fracturing to deepwater and subsea developments, technology has lowered costs and opened new plays. On the downstream side, digital technologies (IIoT, data analytics, automation) are influencing operations and costs. However, they also bring cyber-risk and complexity. (arXiv)

7.5 Environmental, Social & Governance (ESG) Pressure

Oil and gas companies face growing pressure to decarbonise, reduce flaring, methane leaks, meet net-zero commitments. Countries are increasingly legislating for lower carbon emissions. This creates both risk (e.g., stranded assets) and opportunity (e.g., gas as a transition fuel).

The interplay between fossil fuels and renewables is increasingly central to how the oil & gas market will evolve.

7.6 Price Volatility & Uncertainty

Due to the complex interplay of supply, demand, geopolitics, technology and policy, oil and gas markets are volatile. Producers and consumers alike face risks: when prices fall, upstream projects may be shut; when they rise, inflation and economic disruption may follow. Trading, hedging and financial markets play key roles. (arXiv)

7.7 Emerging Market Growth

Although demand in many developed economies is plateauing or declining, emerging markets (Africa, South Asia, Southeast Asia, Latin America) offer growth potential. Urbanization, industrialisation, rising transport demand all drive hydrocarbon consumption. This global shift reshapes where future growth will occur.

8. Oil and Gas Price Movements Explained

To navigate or understand the market, it’s helpful to track how price moves occur and what they reflect.

Supply-side shocks

- Unexpected production cuts (e.g., due to war, sanctions, accidents) can reduce supply and push up prices.

- Conversely, production increases (especially from new low-cost producers) can depress prices.

- Technological breakthroughs that lower extraction cost shift the supply curve.

Demand-side shocks

- Rapid economic growth (especially in emerging markets) can raise demand.

- Slowdowns or recessions reduce demand (e.g., manufacturing slowdown, transport demand drop).

- Policy shifts (carbon tax, EV uptake) reduce growth in demand.

Inventories & storage dynamics

Large inventories signal that supply is outpacing demand; storage costs rise; this can lead to contango in futures markets (future price > spot). (Wikipedia)

Low inventories or depletion of storage capacity may tighten markets and raise spot prices.

Logistical/infrastructure constraints

Even if oil exists, inability to ship, store or refine it can create local supply tightness and influence regional pricing. For example, a pipeline closure or tanker backlog can impact a region’s supply curve independent of global production.

Benchmark/quality adjustments

Different crude oils have different characteristics (API gravity, sulphur content) and so different grades trade at premiums or discounts to benchmarks. As benchmark dynamics shift (e.g., Brent, WTI, Dubai), it influences regional pricing internationally. (Research Guides)

Speculation and future expectations

Oil and gas markets are forward-looking: participants trade not only on current supply/demand, but on expectations of the future. Thus futures markets, hedging, financial flows all matter. (b2broker.com)

For example, expectations of a tightening market may push up futures prices and thus spot prices via arbitrage.

Currency, inflation and macroeconomics

Because oil is priced globally (typically in U.S. dollars), exchange rate movements, inflation, interest rates and general economic health all play a role. A weak dollar often elevates oil prices for non-dollar‐denominated consumers.

9. Global Regional Perspectives in the Oil and Gas Industry

In this section we highlight regional perspectives to illustrate how the oil & gas market plays out differently around the world.

Middle East & North Africa (MENA)

One of the world’s traditional oil-rich regions. Countries here often have large low-cost reserves, state-owned national oil companies (NOCs), and strong export infrastructure. They tend to influence supply globally.

Challenges include: political instability, geopolitical risk, increasing scrutiny over emissions and production, and need for economic diversification.

Example: The Gulf producers still play a key role in global supply management, but competition and global demand dynamics are shifting.

North America (USA & Canada)

The U.S. shale revolution transformed upstream supply: tight oil & shale gas unlocked large volumes of production at relatively low cost. This changed global supply balances and inverted trade flows (e.g., U.S. becoming an oil exporter).

Midstream issues include pipeline approvals, regulatory hurdles, infrastructure bottlenecks. On the demand side: vehicle fuel efficiency, EV trends matter.

Canada’s oil sands are another unique low-quality high‐cost reserve area with major cost and environmental implications.

Asia & Pacific

Demand growth in Asia (China, India, Southeast Asia) is a major driver for global hydrocarbons demand. Urbanisation, industrial expansion, rising mobility push oil/gas consumption.

However, infrastructure challenges (in refining, shipping, pipelines) are significant. Asia is less self-sufficient in supply, so it is more exposed to global market changes.

Africa

Africa is a continent of both opportunity and challenge. Many countries have significant hydrocarbon potential (onshore, offshore), but often face regulatory, infrastructural, political and governance hurdles.

For many African economies, oil & gas revenues are a major part of GDP, which creates both opportunity (for growth) and risk (resource dependency, revenue volatility). Demand within Africa is also rising (transport, power, industry) though from a lower base.

Europe

In Europe, the demand side is constrained by strong efficiency standards, emissions policies, and relatively mature markets. Refining capacity is significant, but structural change (e.g., shift to renewables) is a major focus. Infrastructure (pipelines, LNG import terminals) is critical. Supply is more exposed to non-European imports (Russia, Middle East, North Africa) and to policy/regulation driven change.

10. Future Risks and Opportunities in the Oil and Gas Market

Risks

- Commodity price risk: For producers and governments dependent on income from oil/gas, price collapses are existential threats.

- Stranded-asset risk: As the energy transition accelerates, some oil/gas reserves/projects may never be developed or may become uneconomic.

- Regulatory/policy risk: Carbon taxes, fuel standards, flaring regulations, methane leakage rules — these can raise cost or restrict production.

- Geopolitical risk: Conflicts, sanctions, trade disruptions, supply chokepoints — all can derail market assumptions.

- Operational/technical risk: Drilling failures, environmental disasters (oil spills), infrastructure accidents, midstream disruptions.

- Demand risk: If mobility transitions faster (e.g., EV adoption) or energy efficiency accelerates, demand growth may fall short of expectations.

Opportunities

- Emerging market demand: Regions with low consumption per capita but rising incomes may drive incremental demand growth for years.

- Natural gas as a transition fuel: Gas emits less CO₂ than oil/coal, and LNG infrastructure is expanding — potentially bridging toward lower-carbon energy.

- Value chain optimisation: Digital technologies, automation, data analytics can reduce cost and improve efficiency in all segments.

- New resources/plays: Deepwater, Arctic, unconventional resources may open new supply frontiers (though at higher cost).

- New business models: Integrated energy companies may combine fossil fuel assets with renewables, hydrogen, carbon capture and storage (CCS) to navigate transition.

The Future Landscape

While the precise path of the oil and gas market is uncertain, some broad themes seem likely:

- Demand growth for oil may slow, plateau or decline in certain regions; natural gas may remain resilient or even grow as a transition fuel.

- Investment discipline will matter: fewer low-cost new discoveries mean existing producers may dominate.

- Market volatility will remain, but structural forces (efficiency, renewables, policy) will progressively shape the long-term demand horizon.

- Regions with lower cost of production and access to infrastructure will be advantaged.

- Companies and countries that adapt — embracing emissions reduction, diversifying energy portfolios, improving governance — will likely fare better.

11. How This Affects Stakeholders

Consumers

- Fuel and energy prices affect transport costs, electricity bills, heating/cooling costs.

- Changes in oil/gas markets influence inflation, cost of goods, global supply-chain.

- Consumers in emerging markets may benefit from expanded access to energy; in developed nations, transitions to cleaner energy may impact employment in fossil fuel sectors.

Companies

- Oil & gas companies must navigate upstream risk, cost pressures, regulatory shifts, environmental scrutiny.

- Downstream and midstream firms must optimise operations, manage logistics and adapt to changing feedstocks, alternative fuels.

- Service companies (drilling contractors, equipment providers) face cyclicality and technological disruption.

Governments & Policy-Makers

- Countries reliant on hydrocarbon exports must manage revenue volatility, invest in diversification and ensure sustainable fiscal policy.

- Governments must balance energy security (ensuring reliable supply) with environmental/climate commitments.

- Infrastructure planning (pipelines, LNG terminals, refineries, storage) requires long-term vision; regulation of emissions, flaring, methane leaks is increasingly important.

Investors & Financial Markets

- Commodity cycles affect stock valuations, debt levels, M&A activity.

- Hedging strategies, futures markets, storage play a role in risk management.

- Portfolio managers must consider how exposure to oil/gas intersects with broader economic indicators, ESG criteria and transition risk.

Communities & Workers

- Many regions (especially in producing countries) depend on oil/gas for employment, revenue and local development.

- Transition away from fossil fuels may disrupt coalitions, require reskilling, produce “just transition” issues.

- Environmental and social risks (oil spills, gas flaring, local pollution) affect communities and reputations of companies/governments.

12. Safety and Supply Chain Challenges in Oil and Gas

Since your domain is OilGasSafeGuide.com, it’s worth emphasising the safety, environmental and logistical issues embedded in this market.

Field Decline and Production Maintenance

Even oil fields producing now will gradually decline unless new investment is made. The IEA has pointed out that the industry must spend large amounts simply to maintain production levels. (Financial Times)

Failure to invest can lead to supply shortfalls, with impacts on pricing and energy security.

Transportation & Storage Risks

Pipelines, tanker ships, barges, railroads – all carry safety, environmental and regulatory hazards (spills, leaks, accidents). Storage (tank farms, underground caverns) also poses risks: leaks, fires, community exposure.

A disruption (even temporary) can create bottlenecks that ripple through the chain.

Refineries & Product Safety

Refineries handle flammable, toxic, high-temperature processes. Safety protocols, maintenance, regulations are critical. Downstream product quality standards (especially for global markets) must be met – fuels with poor standards can damage engines, pollute, or be banned.

Environmental & Health Concerns

Exploration, drilling, flaring, gas leaks, oil spills, local air pollution – all of these are real human risks. Regulatory frameworks (emissions, methane leakage, groundwater protection) are increasingly stringent, and failure to comply can result in costs, reputational damage and regulatory action.

Cybersecurity & Operational Risk

As oil & gas companies adopt digital technologies (IIoT, SCADA systems, remote monitoring), they become more exposed to cyber-attacks. Research shows that offshore oil & gas operations are vulnerable. (arXiv)

Operational downtime or sabotage can affect supply, price and safety.

Just Transition & Social Licence to Operate

In many producing regions, communities expect jobs, local development and environmental protection. Companies and governments must manage the transition so it is fair and sustainable, or risk social unrest and project delays.

13. The Future of the Global Oil and Gas Market

For readers of OilGasSafeGuide.com who want to stay ahead, here are some “watch-points” — key themes and indicators to monitor in the coming years:

- Production cost curves: Which producers can sustain profitability at lower price levels?

- Investment flows: Are upstream investments holding up? What about maintenance CAPEX vs growth CAPEX?

- Spare capacity: How much unused production capacity exists globally? If capacity tightens, prices may rise.

- Inventory levels: How are crude and refined product stocks evolving?

- Refinery capacity and cracks: Are downstream margins improving (or deteriorating)? What is the utilization of refining space?

- Transport/logistics bottlenecks: Are there upcoming pipeline projects, shipping constraints, storage expansions?

- Demand growth by region: Which countries/regions are growing fastest? Which are contracting?

- Policy/regulation shifts: Carbon pricing, flaring limits, methane controls, fuel standards — these can change cost structures fast.

- Technological disruption: EV adoption rates, renewables cost declines, hydrogen development – how these impact oil/gas demand.

- Geopolitical developments: Production agreements, trade sanctions, conflicts, alliances (like OPEC+ decisions) – monitor announcements.

- Transition risk: How are companies/countries preparing for a lower-carbon future? Are assets being written down or repurposed?

14. Summary and Key Takeaways

To bring everything together:

- The oil and gas market is global, complex and central to modern economies.

- It is best understood by segmenting into upstream (exploration/production), midstream (transport/storage/processing) and downstream (refining/distribution).

- Supply and demand, trade flows and inventories are the core economic levers; however, layered on top are geopolitics, technology, policy and financial markets.

- Benchmarks like Brent, WTI and others, metrics like crack spread and inventories, and concepts like contango/backwardation help explain price behaviour.

- Regional dynamics matter: costs, infrastructure, market maturity, demand profiles differ across the world.

- The sector faces both significant risks (price volatility, stranded assets, regulatory disruption) and opportunities (emerging demand, gas transition, efficiency gains).

- Environmental, safety and social factors increasingly move from the margin to the centre: companies and countries must manage these to retain their licence to operate.

- For stakeholders — from governments to companies to communities to consumers — the implications are large, and staying informed is critical.

- For the future: the pace of energy transition, technological change, investment patterns and geopolitics will shape how the oil & gas market evolves over the coming decades.

15. Final Thoughts

As you consider the oil and gas market — whether you’re a student, a professional, a policy-maker, a curious reader or part of an affected community — remember two things:

- The forces at work are multi-dimensional: geology, engineering, economics, politics, environment, technology and human behaviour all interplay.

- The future is not predetermined: while historical patterns give us perspective, the global push toward decarbonisation, the rise of emerging economies, the digital transformation of industry and shifts in consumer behaviour mean that the oil & gas market of tomorrow may look very different from what we’ve known.

By understanding the “basics” as laid out here — the segments of the value chain, the supply/demand/trade drivers, the pricing mechanics, and the global dynamics — you are better positioned to make sense of news-headlines, investment decisions, policy shifts, company strategies and ultimately, the real-world impact on jobs, economies and communities.

0 responses to “Understanding the Oil and Gas Market Basics”