Last updated: November 13, 2025

Introduction to Avoiding Fraud in the Energy Industry

Fraud in the energy industry is not a distant threat—it is real, pervasive, costly, and evolving. Whether you are an executive in a global oil & gas company, a supply-chain manager in a power utilities firm, or a regulator, understanding how fraud works and how to prevent it is essential. This article aims to comprehensively explore the topic of avoiding fraud in the energy industry, drawing from real-world cases and best-practice controls, with a global outlook and a human focus.

We’ll cover:

- What we mean by fraud in the energy industry

- Why the energy sector is especially vulnerable

- Types of fraud and scams (upstream, midstream, downstream, renewables, utilities)

- Key drivers and enablers of fraud in the sector

- The consequences—financial, reputational, operational, regulatory

- Red flags and warning signs of fraud

- Strategies and frameworks for prevention and detection

- Role of technology, data, and analytics

- The human/behavioural dimension: culture, ethics, training

- Global regulatory, compliance and governance perspectives

- A roadmap / practical checklist for energy companies to reduce fraud risk

- Final thoughts

Let’s dive in.

1. What is “fraud” in the energy industry?

Fraud generally is defined as “any purposeful action or omission to defraud others, resulting in a loss for the latter and/or a gain for the fraudster.” (Management Solutions)

In the context of avoiding fraud in the energy industry, this definition applies in many contexts, including:

- mis-reporting volumes, grades, or contract performance

- mis-appropriating assets (e.g., equipment, inventory)

- bribery and corruption in procurement, licensing, regulatory approvals

- cyber-fraud: hacking, data tampering, theft of intellectual property

- supply-chain mis-representation (e.g., claiming high-grade fuel when it isn’t)

- utility-customer or consumer-targeted scams (e.g., impersonation of supplier)

- investment and project-fraud schemes (fake deals, bogus renewable energy projects)

For instance, a study of the oil & gas industry highlights “bribery, financial misreporting, asset mis-appropriation and corruption” as major fraud categories in the sector. (Private Investigators You Can Trust)

Fraud can be internal (by employees, insiders) or external (by customers, vendors, third-parties). (Management Solutions)

2. Why the energy sector is especially vulnerable

Understanding why the energy industry faces unique risks is critical for avoiding fraud in the energy industry.

a) Scale and commodity nature

Energy companies move large volumes of high-value commodities (crude, refined products, gas, power). Big dollar flows and complex trading create many opportunities for mis-reporting, manipulation or mis-appropriation. As one article notes: “With so much at stake … it should be no surprise that the oil and gas industry is rife with fraud risks.” (crigroup.com)

b) Complexity of operations & value chains

From exploration, production, processing/refining, transport, trading, distribution, to retail—energy operations are global, multi-jurisdictional, and involve multiple parties. This complexity makes oversight harder and creates gaps that fraudsters exploit. (u4)

The global oil and gas market’s structure and complexity also influence how fraud risks emerge across the value chain. To understand how the energy market operates at its core, read our detailed guide on Understanding the Oil and Gas Market Basics.

c) Regulatory, political & geographic exposure

Many energy assets are located in high-risk regions (political instability, weak governance, corruption). Procurement, licensing, permitting all involve regulatory interface and hence risk of bribery and corruption. (u4)

d) Transition and technological change

As the industry shifts (towards renewables, digitisation, IoT, smart grids) new technologies and supply-chain models bring new fraud risks: smart meter tampering, data manipulation, cyber intrusions. For example, electricity theft (a type of fraud) is a major non-technical loss in power systems. (MDPI)

e) Procurement & vendor risk

Many energy firms outsource large portions of their work (construction, pipelines, operations, services). Vendor relationships, change orders, subcontracting are ripe for procurement fraud. A midstream oil & gas article flagged procurement/vendor fraud as common. (Weaver)

f) Undetected / under-reported fraud

Interestingly, energy & natural resources companies may be less likely than other sectors to report fraud—but this may reflect weak detection rather than low incidence. (KPMG)

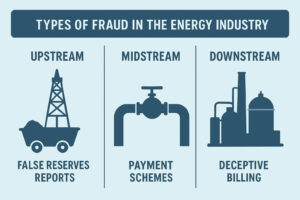

3. Types of fraud in the energy industry

Fraud can occur across every link of the value chain. Learning to identify each type is key to avoiding fraud in the energy industry. Many of these fraud schemes are tied to core industry activities such as exploration, refining, and trading — areas you can better understand through our Ultimate Guide to Oil and Gas Terminology, which defines key concepts across the sector.

3.1 Upstream (Exploration & Production)

- Mis-reporting production volumes, reserve estimates, well performance to boost value.

- Asset mis-appropriation: e.g., equipment theft, unauthorized use of rigs, theft of crude.

- Bribery/corruption of licensing, concession awards, or land access.

- Partner-shareholder collusion: hiding costs, mis-allocating investments.

3.2 Midstream (Transport, Storage, Pipelines)

- Change-order abuse in large pipeline/construction projects: under-bid then inflate via change orders. (Weaver)

- Vendor invoice fraud: double billing, fictitious vendors, over-billing for hours or materials. (Weaver)

- Theft of oil/gas in transit (e.g., siphoning pipelines) or illegal tapping.

- Smuggling, identity of cargo, mis-labelled shipments.

3.3 Downstream (Refining, Distribution, Retail)

- Mis-grading of products (e.g., selling low-quality fuel as premium).

- False documentation of feedstocks or finished products.

- Retail theft, skimming at service stations.

- Utility fraud: meter tampering, unauthorized supply, billing fraud.

3.4 Utilities & Renewables – Power, Gas, etc.

- Electricity theft, meter tampering, unauthorized connections. (MDPI)

- Utility scams: impersonation of supplier, fake repair/upgrade visits, “you will be disconnected” threats. (UCA Helps)

- Renewable-investment scams: bogus solar/wind projects, mis-representing returns. (WIRED)

- Mis-reporting environmental disclosures, emissions, clean-energy credentials. (E.g., recent case of false environmental impact reports in US oil-gas firms.) (The Guardian)

3.5 Trading & Financial-fraud

- Benchmark/manipulation of oil/gas pricing indices. (E.g., trading firm fined for manipulation) (Reuters)

- Bribery or corruption in contract awards, or rigging tender processes.

- False or inflated investment offerings in energy sector (bogus partnerships, lease schemes) (crigroup.com)

4. Key drivers & enablers of fraud

The first step in avoiding fraud in the energy industry is understanding why it happens.

a) Weak internal controls & oversight

Weak governance, poor separation of duties, weak audit/tracking systems give space for fraudulent actors. For example, internal control weaknesses in oil & gas firms strongly correlate with fraud incidents. (ResearchGate)

b) Collusion

Often fraud isn’t one rogue employee—it may involve multiple parties: vendor + company employee + contractor. Collusion multiplies risk e.g., vendor fraud in mid-stream cases. (Weaver)

c) Lack of transparency & complex value chain

When operations span multiple geographies, multiple intermediaries, it becomes difficult to trace flows, shipments, contract fulfilment. Complexity breeds opacity.

d) Incentive mis-alignment / performance pressure

High targets, aggressive growth goals, bonus compensation aligned to volumes or cost-savings may push people toward unethical shortcuts or misreporting.

e) Technological vulnerability

Digitisation, IoT-enabled devices (smart metres, SCADA systems), remote operations bring new attack surfaces: cyber intrusion, data manipulation, meter tampering. (arXiv)

f) Regulatory/market environment

In jurisdictions with weak rule-of-law, weak enforcement, high corruption risk, fraud is more likely. Procurement fraud, bribery, and corruption flourish when oversight is light. (u4)

g) Complacency / cultural issues

Some firms assume “we’re too big/too reputable to be fraudsters’ target” – complacency is itself a risk. As pointed out in the KPMG fraud outlook: “Complacency surrounding fraud is a danger among energy and natural resources companies.” (KPMG)

5. Consequences of fraud in the energy industry

The cost of fraud extends beyond lost funds. Understanding the fallout underscores why avoiding fraud in the energy industry must be a top priority.

Financial loss

Obviously, direct mis-appropriation, overbilling, theft all drain financial resources. For example, vendor/procurement fraud is cited to cause substantial harm in mid-stream firms. (Weaver)

Reputational damage

When fraud is exposed, companies face media scrutiny, investor backlash, regulatory penalties. The case of benchmark-manipulation by a major trader (US $55 m fine) is a cautionary tale. (Reuters)

Operational risk & safety

Fraud in energy isn’t just about money—it can undermine operational integrity. Example: meter tampering affects grid stability; theft of crude can affect production planning; cyber-intrusion into SCADA can cause major safety issues. (arXiv)

Regulatory & legal exposure

Non-compliance, false reporting, bribery/corruption lead to legal sanctions, fines, debarment, delayed contracts.

Impact on investors & stakeholders

Investors rely on accurate financials, reserves, production reports. Fraud undermines trust, may lead to share-price collapse or funding problems.

Wider societal/consumer harm

In utilities, fraud (e.g., scams) can harm the end-consumer financially; energy theft may raise costs for other customers; false environmental disclosures can impact public health and environmental trust. (See recent U.S. oil-gas firm environmental-fraud case.) (The Guardian)

6. Red flags & warning signs of fraud

Recognizing early indicators is essential to avoiding fraud in the energy industry.

- Unexplained cost overruns; large number of change orders in contracts.

- Vendors with no track record, unusual billing patterns (e.g., hours > 24/day as noted). (Weaver)

- Unusual relationships between suppliers and internal staff (e.g., vendor employee also an inside employee).

- Invoicing for work not done, duplicate billing, inflated quantities or rates.

- Sudden changes to procurement or vendor lists without transparency.

- Meter readings that are out of pattern (very low or very high).

- Customer complaints of bills that don’t match usage; new suppliers or switching without clear consent. (See utility scam red flags: pressure to act immediately, unconventional payment methods). (UCA Helps)

- Inconsistent quality/grades of fuel/materials vs. documentation.

- Weak or missing audit trails; delays in financial/accounting reconciliation.

- Lack of segregation of duties: same person authorises contract, receives goods, pays vendor.

- Culture signs: reluctance to question supplier/vendor behaviour; employees fear speaking up.

- Cyber-related anomalies: unusual network traffic to/from SCADA or sensor/IoT devices; unverified changes to sensor output. (See smart grid false data attack research.) (arXiv)

7. Prevention & detection strategies

Proactive defense is the cornerstone of avoiding fraud in the energy industry. A layered approach includes governance, controls, and technology.

Governance & tone at the top

- Senior leadership must set ethics and zero-tolerance for fraud; foster an open-culture of transparency and whistle-blowing.

- Board and audit committee oversight: ensure fraud risk is a standing agenda item.

- Clear accountability: define roles and responsibilities for fraud prevention and investigation.

Risk assessment

- Regularly evaluate fraud risk across value-chain: upstream, midstream, downstream, utilities, renewables.

- Map fraud risk scenarios: e.g., procurement risk, vendor risk, meter tampering, trading manipulation.

- Use external benchmarking and experience-share (industry bodies, peer reports).

Internal controls & segregation of duties

- Segregate procurement, vendor-selection, payment, and operations oversight.

- Implement purchase-order controls, authorisation thresholds, vendor due-diligence.

- Use periodic vendor review, rotation of vendors, independent validation of large contracts or change orders.

Data analytics and monitoring

- Deploy analytics to flag anomalies: e.g., unusually high vendor billing, irregular meter readings, patterns of change orders.

- Use technology to monitor smart-meter, IoT signals, pipeline flow/throughput, distribution anomalies.

- Employ continuous monitoring rather than only periodic audits.

Procurement & vendor management

- Rigorous vendor due-diligence: verify vendor legitimacy, ownership, track-record.

- Competitive tendering, open bidding, and transparency.

- Monitor vendor invoices for inflated quantities, duplicate billing, change-order abuse.

- Periodic vendor audits, surprise inspections.

Cybersecurity & physical security

- Protect SCADA, IoT systems, remote equipment from intrusion/tampering. (See offshore oil & gas cyber-vulnerability research). (arXiv)

- Monitor for non-technical losses (i.e., theft, tampering) especially in utilities. (MDPI)

- Provide training to employees and contractors on phishing, impersonation scams, data security.

Whistle-blower systems & culture

- Provide anonymous reporting channels, protect whistle-blowers.

- Encourage employees, contractors to report suspicious behaviour without fear of retaliation.

- Investigate all reports thoroughly.

Training & awareness

- Regular training for staff at all levels (operations, procurement, finance) on fraud risks, red flags, ethics.

- Use case studies from the industry.

- Highlight that fraud isn’t always blatant—it may start small.

External audit & assurance

- Independent external audit covering fraud risk, vendor payments, procurement cycles.

- For global operations, internal audit functions should coordinate across geographies.

- Use forensic audit or investigation when suspicion arises.

Incident response & remediation

- Have a clear fraud-response plan: detection → investigation → remediation → lessons learned.

- When fraud is found: act decisively, communicate (internally and externally as needed), and strengthen controls.

- Document root-cause and update risk assessment.

8. Role of technology, data & analytics

In avoiding fraud in the energy industry, technology plays a dual role—as both a vulnerability and a safeguard.

Technology as an enabler of fraud

- Smart-grids, IoT devices, remote sensors (in oil & gas, offshore) create new attack surfaces (tampering, data manipulation). (arXiv)

- In utilities, meter-tampering, illegal connections, non-technical losses are significant fraud vectors. (MDPI)

- Trading platforms, benchmark indices are susceptible to manipulation and insider-information abuse.

Technology as part of the solution

- Data-analytics: large-scale monitoring of vendor payments, logistics flows, production/throughput, meter readings to flag anomalies.

- Machine-learning models to detect unusual usage patterns, meter tampering, non-technical losses. (Note: adversarial risks exist to ML models though.) (arXiv)

- Blockchain & smart-contracts in supply-chain: some research suggests using blockchain for traceability in oil supply-chain to reduce fraud/mis-representation. (arXiv)

- Real-time dashboards and KPIs: throughput vs expected, vendor invoice trends, contract change-order ratios.

- Cyber-security platforms: intrusion detection in SCADA/IIoT, anomaly detection for remote operations.

- Digital identity / verification for vendors, customers; audit-trail management.

Implementation pointers

- Technology cannot replace governance and controls—it complements them.

- Start with data-quality: ensure you have reliable foundational data before building advanced analytics.

- Prioritise the highest-risk areas (e.g., procurement, vendor payments) for analytics.

- Ensure you have people with analytics skills and forensic mindset.

- Remain aware of evolving fraud methods (e.g., adversarial attacks).

- Balance investment: technology costs vs expected fraud-loss reduction.

9. The human & cultural dimension

Even the best controls can fail if the human/cultural dimension is weak. Humans remain at the heart of energy-industry fraud—both perpetrators and victims.

Culture of integrity

- Leadership must set the tone: ethical culture, speaking up, transparency.

- Avoid heroic “sales-justifies-ends” culture: pressure on targets can motivate unethical shortcuts.

- Celebrate “right behaviour” as much as financial targets.

Training & awareness

- Employees often are the first line of defence: teach them red-flags, how to respond when something seems off.

- Include contractors/vendors in training: they may operate in remote locations and carry unique fraud-risk.

- Use real-world industry case-studies to make the risk tangible.

Whistle-blowing & safe reporting

- Ensure employees feel safe reporting suspicious behaviour or irregularities.

- Confidential channels or third-party hotlines help.

- Take reports seriously—respond visibly and meaningfully.

- Show follow-through: if people see that reports lead to action, they are more likely to speak up.

Behavioural incentives

- Ensure incentives (bonuses, rewards) don’t implicitly reward excessive risk-taking or cost-cutting that bypasses controls.

- Review individual/departmental incentives with fraud-risk lens.

- Make clear that cutting corners isn’t rewarded.

Human-factor in fraud detection

- Fraudsters often exploit human vulnerabilities: colluding vendors, friendly relationships with employees, pressure on staff, inadequate oversight.

- Regular rotation of duties, job-changes, surprise vendor audits help reduce opportunity for collusion.

10. Global regulatory, compliance and governance perspectives

Given the global footprint of many energy firms, fraud-prevention must align with regulatory regimes, governance best-practices, and evolving global standards.

Key regulatory/compliance elements

- Anti-bribery & corruption regimes (e.g., UK Bribery Act, U.S. FCPA) apply in many jurisdictions.

- Financial-reporting and accounting standards require companies to report material fraud or internal control weaknesses.

- Industry-specific regulations: e.g., licensing, safety, environmental reporting (fraud in environmental-reporting recently exposed in U.S. oil-gas). (The Guardian)

- Utility regulators often impose penalties for consumer-fraud, false billing, mis-representation.

Governance best-practices

- International frameworks (e.g., COSO Fraud Risk Management, ISO 37001 anti-bribery) provide guidance.

- Energy firms must embed fraud-risk in their enterprise-risk framework, and link with compliance, audit, cybersecurity.

- Global operations must consider different local-law risks and cultural/regulatory environments; e.g., procurement fraud risk in Africa has been studied. (u4)

- Disclosure: investors and stakeholders increasingly demand transparency on fraud-risk management, controls, incident reporting.

Case-studies & lessons

- The case of a global commodities firm paying US $55m to settle manipulation/fraud charges (see earlier) underscores the cost of non-compliance. (Reuters)

- Fraud in the oil & gas industry is gaining heightened regulator attention, and the energy sector should not assume immunity. (Private Investigators You Can Trust)

Global dimension

- Supply-chains cross multiple countries; companies must understand local risk: weak governance, corruption, illicit practices.

- Uniform global policies (e.g., vendor-due-diligence, internal audit rotation) help avoid “weak-link” risk in one country harming global operations.

- Partnerships with global audit/forensic firms help experience-share cross jurisdictions.

11. Roadmap & Practical Checklist for Energy Companies

Here is a practical sequential checklist that energy companies—regardless of size—can adopt to reduce fraud risk.

1st Phase: Assessment

- Map your value-chain: upstream, midstream, downstream, distribution, retail.

- Identify and prioritise high-fraud-risk areas (e.g., procurement, vendor payments, trading, meters, supply-chain).

- Review historical incidents internal & external (industry benchmark) to understand your exposure.

- Conduct a control-environment diagnostic: how strong are your internal controls, oversight, audit, data-analytics?

- Evaluate culture perceptions: are employees aware, do they feel able to speak up, is tone-at-top clear?

2nd Phase: Design/Strengthen Controls

- Establish governance: board/committee oversight, fraud-risk agenda, internal audit function with fraud focus.

- Implement/strengthen vendor-due-diligence procedures; vendor rotation; surprise audits.

- Introduce analytics/monitoring tools: vendor invoice anomaly detection, meter usage spikes, contract change-orders ratio.

- Strengthen cyber-security/physical-security especially for remote assets, IoT, smart-meters, SCADA systems.

- Develop whistle-blower system (anonymous, third-party if appropriate), ensure protection and follow-up.

- Train employees (procurement, finance, operations, site-staff) on fraud-risk awareness, red-flags, ethical behaviour.

3rd Phase: Monitoring & Detection

- Monitor vendor invoices: duplicate invoices, unit-rates higher than benchmark, vendors with no real business operations.

- Monitor contractual change-orders and cost overruns: unusually high number of change-orders might signal abuse. (Weaver)

- Monitor meter/usage data: sudden drops in recorded usage (meter-timing), spikes, irregular patterns.

- Monitor trading/benchmark exposures: internal controls around trading desks, benchmark reporting, insider-info risk (see trading-fraud case).

- Use data-analytics dashboards to generate red-flag lists, then triage for investigation.

- Conduct periodic internal forensic reviews, surprise audits, and vendor site inspections.

4th Phase: Investigation & Remediation

- Should suspected fraud arise: engage forensic team (internal or external), secure evidence, preserve chain-of-custody.

- Communicate incident appropriately to stakeholders: board, audit committee, regulators (if required).

- Remediate: remove dishonest actor, update controls, retrain staff, adjust vendor list, rotate staff.

- Conduct root-cause analysis: what control failed? Was collusion involved? What data/analytics could have flagged it earlier?

- Document lessons-learned and update risk-assessment accordingly.

5th Phase: Continuous Improvement

- Fraud-risk is dynamic: new technologies, new business models, new geographies bring new exposures (e.g., renewables scams, smart-metre tampering).

- Periodically revisit controls, update analytics models, refresh training.

- Benchmark against peer-industry: review published fraud-case studies, industry reports.

- Maintain vigilance: ensure the tone-at-top remains strong, encourage culture of transparency.

- Share lessons across the organisation: operations, procurement, finance, trading, IT all must be aligned.

12. Final thoughts

Avoiding fraud in the energy industry is neither inevitable nor uncontrollable—but it demands continuous focus. The size, complexity and global nature of the sector mean that the stakes are high: financial losses, reputational damage, regulatory penalties and safety/operational consequences.

What sets apart effective organisations is not simply the existence of policies and controls—but the embedding of fraud-risk awareness into the culture, the use of data and analytics to monitor real-time behaviour, and leadership that views fraud prevention as strategic rather than compliance-only.

For your organisation—whether upstream oil & gas explorer, pipeline company, or renewable energy producer—the path forward involves:

- honest assessment of your unique fraud-risk exposures;

- putting in place the right controls, governance and monitoring tailored for your value-chain;

- leveraging technology but not relying solely on it;

- fostering a culture where suspicious behaviour is flagged without fear and where the incentives promote the right behaviour;

- and staying attuned globally to new risk trends (digital, supply-chain, cyber, renewables).

Remember: in the energy industry, the smartest fraud-prevention isn’t just about catching what’s wrong—it’s about building systems and cultures so that what’s wrong rarely happens in the first place.

FAQ: Avoiding Fraud in the Energy Industry

Q1. What are the most common types of fraud in the energy industry?

Common types include procurement fraud, bribery, asset misappropriation, billing manipulation, fake vendor schemes, meter tampering, and cyber-related attacks on smart systems.

Q2. How can companies detect fraud early in the energy sector?

Early detection relies on internal controls, data analytics, and whistleblower programs. Real-time monitoring of invoices, supplier activity, and meter data helps identify red flags fast.

Q3. Why is avoiding fraud in the energy industry so important globally?

Fraud drains billions annually, disrupts energy markets, and erodes trust in sustainable development. Globally, avoiding fraud in the energy industry protects economic stability and corporate reputation.

Q4. What role does technology play in preventing energy sector fraud?

Modern technologies like AI, blockchain, and predictive analytics detect anomalies, secure transactions, and increase transparency across the energy value chain.

Q5. How can small or mid-size energy firms protect themselves from fraud?

They can implement affordable internal audits, train employees in fraud awareness, verify vendors, and use cloud-based monitoring tools to detect unusual transactions.

0 responses to “Avoiding Fraud in the Energy Industry”